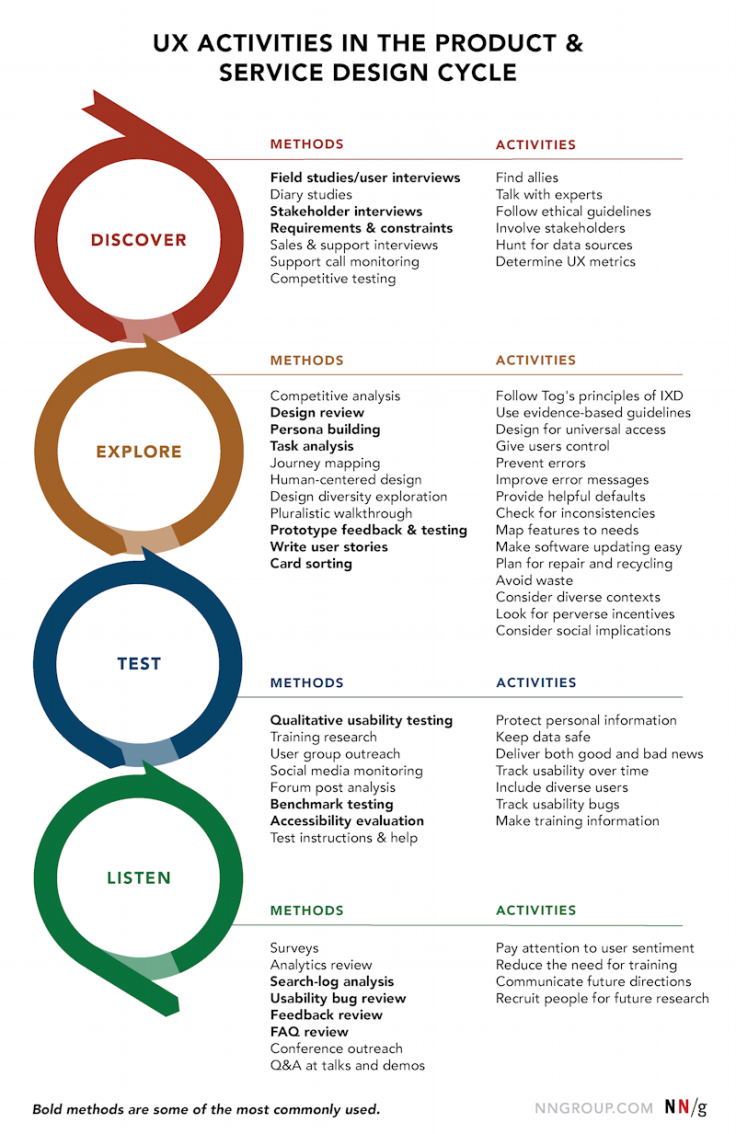

The qualitative research process, end-to-end

The qualitative research process: step by step guide

Although research processes may vary by methodology or project team, some fundamentals exist across research projects. Below outlines the collective experience that qualitative researchers undertake to conduct research.

Step 1: Determine what to research

The first step in doing research is determining what to research. Researchers will look through any product roadmaps, strategy documents, data, customer feedback, and conversations with stakeholders to identify potential knowledge gaps or research opportunities.

Once a researcher has determined a list of potential projects to tackle, they will prioritize projects based on the business's impact, available resourcing, timelines & dependencies to create a research roadmap. For each project, they will also identify the key questions they need to answer in the research.

The researcher should identify the participants they plan to research, and any key attributes that are a 'must-have' or 'nice to have' as these can be influential in determining the research approach (e.g. a niche group may require a longer timeline to recruit).

Researchers will generally aim for a mix of project types. Some may be more tactical or requests from stakeholders, and some will be projects that the researcher has proactively identified as opportunities for strategic research.

Step 2: Identify how to research it

Once the researcher has finalized the research project, they will need to figure out how they will do the work.

Firstly, the researcher will look through secondary data and research (e.g. analytics, previous research reports). Secondary analysis will help determine if there are existing answers to any of the open questions, ensuring that any net-new study doesn't duplicate current work (unless previous research is out of date).

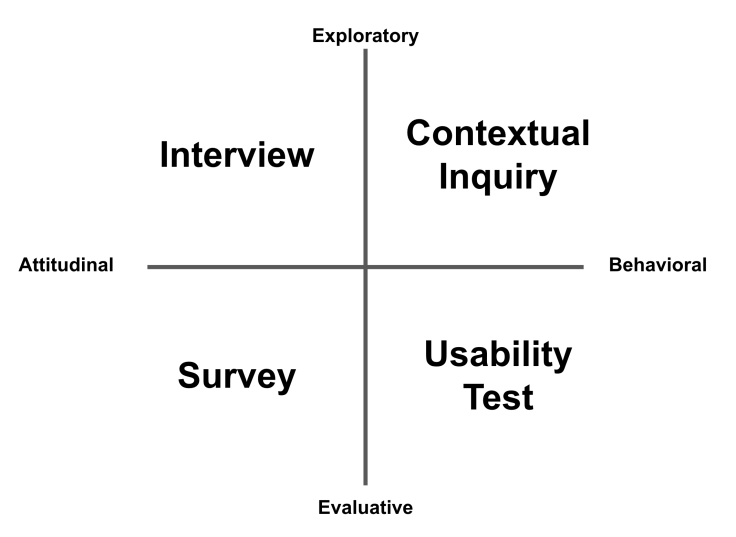

After scoping the research, researchers will determine if the research input needs to be attitudinal (i.e. what someone says) or behavioral (i.e. what someone does); as well as if they need to explore a problem space or evaluate a product – these help determine the methodology to use. There are many methodologies out there, but the main ones you generally will find from a qualitative perspective are:

Interviews [Attitudinal / Exploratory] – semi-structured conversation with a participant focused on a small set of topics. Runs for 30-60 minutes.

Contextual Inquiry [Behavioral / Exploratory] – observation of a participant in their environment. Probing questions may be asked during the observation. Runs for 2-3 hours.

Survey [Attitudinal / Evaluative] – gathering structured information from a sample of people, traditionally to generalize the results to a larger population. Surveys should generally not take participants more than 10 minutes to complete.

Usability Test [Behavioral / Evaluative] – evaluating how representative users are, or are not, able to achieve critical tasks within an experience.

Check out these articles for more information about different methodologies:

Step 3: Get buy-in and alignment from others

Once a researcher has determined what they will be researching and how they will research it, they will generally write up a research plan that includes additional information about the research goals, participant scope, timelines, and dependencies. The plan is typically either a document or presentation shared with stakeholders depending on the company and how they work.

After the research plan is complete, researchers will share the plan for feedback and input from their stakeholders to ensure that the stakeholders have the right expectations going into the research. Stakeholders may ask for additional question topics to be added, ensure that research will be executed against specific timelines, or provide recommendations on how the study will help make product decisions.

At organizations where there is a research team, researchers may also share their plan with other researchers informally or through a 'crit' process. Generally, researchers will provide feedback on the research craft, such as methodologies, participant mixes, and the research goals or questions.

Once the researcher feels confident in their plan, they will either begin to plan the research, or in the case of more junior researchers, get approval from their manager to begin the study.

Step 4: Prepare research

This step is where the researcher will get all of their ducks in a row to execute the research. Preparation activities include:

Equipment: Booking venues, labs, observation rooms, and procuring any appropriate equipment needed to run the study (e.g. cameras, mobile devices).

Participants: Sourcing participants from internal / external databases, reaching out/scheduling participants, managing schedule changes.

Incentives: Find budget, identify incentive type (e.g. Amazon gift card? customer credit? gift baskets), and purchasing.

Assets: Building relevant designs / prototypes (with design or design technologists), creating interview / observation guides and other research tools needed for sessions (e.g. physical cards for in-person card sorts).

Legal & Procurement: Participant waivers or NDAs preparation to ensure they are sent in advance of the research session to participants, vendor procurement, and management.

If Research Operations exists within an organization, they will generally take on most of the load in this area. The researcher will focus on assets required for executing research, such as interview guides.

In some cases, vendors may be engaged for some of these requirements (e.g. labs, participants, and incentive management) if resourcing is not available internally or if a researcher wants a blinded study (i.e. the participant doesn't know what company is running the research). In this case, additional time is incorporated to brief, onboard, and get approvals to work with the vendor.

Step 5: Execute research

Now the researcher gets to research!

Researchers will generally aim to execute research activities for 1–2 weeks, depending on the methodology to ensure they can be efficient in execution. In some more longitudinal methods (e.g., diary studies), or if a participant type is harder to recruit, it may take longer.

In consumer research, there will usually be back up participants available in case of no shows. However, in business or enterprise research, researchers will engage will all recruited participants as participants will generally have relationships with other parts of the company (e.g. sales). It is essential to maintain those relationships post-research.

During sessions, in a perfect world, there is one facilitator (principal researcher). In some cases, a secondary attendee who takes notes – this can be a stakeholder or a more junior researcher who can then learn soft skills from the primary researcher. By delegating note-taking, the principal researcher can focus on driving and managing the participant's conversation.

However, in most cases (especially if there is a "research team of one"), researchers will try to have to do both facilitation and documentation – this can lead to a clunkier conversation as the facilitator attempts to quickly write notes between trying to think of the next question. If a researcher decides to record a session instead, they will have to spend additional time after the research listening to the full recordings and writing notes.

In qualitative research, researchers may begin to see patterns in the findings after five sessions. They may start to tailor the research questions to be more specific to gaps in their understanding.

Researchers may also set up an observation room for stakeholders (or share links to remote sessions) to attend live. Generally, researchers will have a backchannel (e.g., slack, chat, or SMS), so if a stakeholder has a follow-up question to an answer, the researcher can dig deeper. In some cases, researchers will give stakeholders an input form to take their notes that can be shared with the researcher afterward - this can be useful for the researcher to understand how the stakeholder views the research and what the stakeholder perceives as necessary to the research insights.

Step 6: Synthesize and find insights

Once the research capture is complete, the researcher will then aggregate findings to begin to look for common themes (in exploratory) or success rates (in evaluative). Both of these will then lead to insight generation that researchers will then look to tie back to the project's original research goals.

As analysis can be one of the most high-effort tasks in research, researchers will lean towards how to be efficient in their study, generally using digital tools, hacks, or workarounds. Researchers will usually create the analysis process they refine throughout their careers to help them become more efficient.

In cases where researchers are looking to get buy-in for research or capture stakeholder input, they may seem to more visual approaches (e.g. post-it affinity analysis) in war rooms. This process can take longer to process (especially if there is a high volume of data). Still, there can be a higher impact on analyzing research in this way – especially if the researcher is looking to get buy-in for future projects.

Step 7: Create research outputs

After a researcher identifies the key themes and insights, the researcher will reframe these findings to a relevant research output to ensure that stakeholders understand and buy-in to the outcomes. Outputs may include:

Report: Outlines vital findings from research in a document or presentation format. Will most likely include an executive summary, insight themes, and supporting evidence.

Videos: A highlight reel of supporting evidence from crucial findings. Generally seen as more useful and engaging compared to just a report. In most cases, the video will help the research report.

Personas: A written representation of a product's intended users to understand different types of user goals, needs, and behaviors. Also used to help stakeholders build empathy for the end-user of the product.

Journey Map: A visualization of the process that a person goes through to accomplish a goal. Generally created in conjunction with a persona.

Concepts / Wireframes / Designs: If research is evaluative, designs can visualize recommendations.

Storyboarding

Before a researcher makes the output, researchers will spend time planning the structure and storyboarding. Storyboarding is incredibly essential to help researchers define information requirements and ensure they present their findings in the most impactful way to stakeholders.

Having a point of view in outputs

Historically, researchers have tried to stay neutral to the data and not try to have a strong opinion or perspective to let the data speak. However, as researchers become more embedded in the industry, this has shifted to stakeholders wanting a strong point of view or recommendations from researchers that can help other stakeholders (especially product managers and designers) decide the knowledge captured as part of the research.

Having a strong perspective helps researchers have a seat at the table and appear as a trusted advisor/partner in cross-functional settings.

After the research outputs are complete, some researchers will do a "pre-share" or walkthrough with key stakeholders or potential detractors to the research. The purpose of these meetings is to align with stakeholders' expectations and find potential 'watch-outs' (things that may derail a presentation).

Researchers will generally have to share their findings out multiple times to different stakeholder groups and tailor them for each audience. For example, executive meetings will be more higher level than a meeting with a product manager.

After sharing, researchers will follow up with key stakeholders (especially those who provided input to the research) to confirm they understand the findings and identify next steps. Next steps may include incorporating results in product strategy documents, proposals / PRDs, or user stories to ensure that the recommendations or findings have been reflected or sourced.