What you need to know about primary market research

Market analysis template

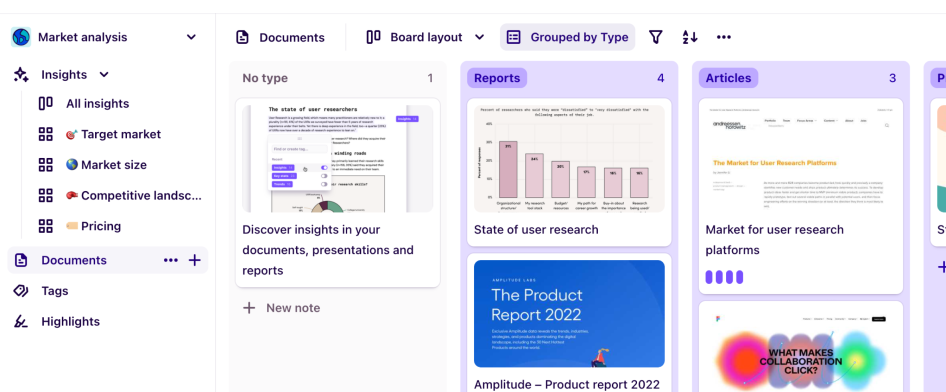

Save time, highlight crucial insights, and drive strategic decision-making

Use template

What is primary market research?

Primary market research can help you figure out your target market's wants and needs and how you can meet them. You can carry out this research in many ways, including:

Primary market research not only allows you to work out how to sell your product or service more effectively but also helps you see the types of consumers that are not your target market.

It can be qualitative or quantitative data, or a combination of both to help your business gain insight into the market.

These valuable marketing insights will save you time and money and enable you to use your resources much more effectively.

Why use primary market research?

While secondary research can give you a more generalized look at overall trends and markets, primary research focuses on a specific, customized aspect.

Secondary market research may be easier and faster, but primary research is more tailored, and you get data ownership of the results.

Primary vs. secondary market research: what's the difference?

Secondary market research has already been gathered and can be used where relevant. Reports and surveys by other businesses or government agencies are a form of secondary market research.

Primary market research is carried out by you with your customers or clients, so it is more focused on your direct business. It may take longer and cost more than secondary research, but it is more targeted.

Secondary market research is more general and may not focus solely on things that affect your business and goals.

Primary market research: research approaches

There are five main primary market research approaches:

Observational research

Survey research

Experimental research

Interviews

Focus groups

Observational research

Observational research is used to watch customers in their natural setting and is used extensively in marketing. There is little control over the components of the research; the aim is to observe the interaction between the consumer and the product or service.

There are two forms of observational research:

Strict observation: the researcher can only watch the consumer and make notes. This is one of the best ways to get raw data without any outside interference.

Slight interaction: the researcher may interact with the customer but not influence or sway the research in any way

Survey research

Surveys extract data from existing customers or potential customers who have consented to receive marketing material and given their contact information. You can gather feedback, explore customer experience of your service or product, and analyze business hypotheses.

Decide on the target market to give the survey to; the more survey respondents, the more reliable the result.

Surveys are good for getting quantitative data such as:

Household income

Purchasing patterns

Price research

These surveys can be in person or via phone, email, or online questionnaire. Alternatively, you could use the "old-school" method of sending out a direct mail form.

Experimental research

Experimental research, also known as field research, is a quantitative approach to getting consumer information. Experiments are performed in an uncontrolled setting to test certain variables and answer questions on how consumers use your product or service and what their buying habits are.

While conducting these experiments, you can talk with people in the natural retail setting to see their true-to-life interaction with the product or service.

Experimental research provides accurate data without moderation and can give you insight into the product or service, levels of customer satisfaction, and your business and brand in general.

Interviews

Interviews are more like a one-to-one focus group scenario in which you question one person instead of a group. Structured but open-ended questions are used so you can discover preferences and behavior as well as consumer experience with your product or service.

Interviews are ideal when testing a soft or new launch or to get customer perceptions of your marketing campaign.

These interviews get high response rates which are more truthful than other methods, as there is no peer pressure or influence from a group setting. Follow-up questions can help refine the data further.

Focus groups

Focus groups are great for discovering a specific demographic's opinions. They are best suited to collecting qualitative research.

This research method allows businesses to obtain data and analyze it from a specific market segment, with in-depth answers. This is helpful for decision-making and fine-tuning a product or service.

Many companies use focus groups to play through "what if" scenarios before implementing them in real life or for A/B testing on marketing material.

When to use primary vs. secondary market research

The decision of whether to use primary or secondary market research is up to each business. Primary research is mainly done when the business needs recent data for a specific context. They want to look at a particular research aspect.

Secondary research is chosen when existing data can be insightful without the need for customized data or specifics. It can be gathered for the core of research projects.

FAQs

What are the four types of secondary market research?

The four main types of secondary market research are:

Government or organizational agencies

Commercial and trade reports

Market research intelligence tools

Competitor websites

These all are sources of existing data about target groups that may benefit your business.

Why are interviews used in market research?

A form of primary research, interviews allow direct feedback from customers and clients to help inform a business about its consumers’ needs.

The researcher can use client responses from interviews to come up with more customized questions. They can extract more research information and more comprehensive answers than from other research methods.

Should you be using a customer insights hub?

Do you want to discover previous research faster?

Do you share your research findings with others?

Do you analyze research data?